no start-ups!

only acknowledged businesses, only respected people,

only key words!

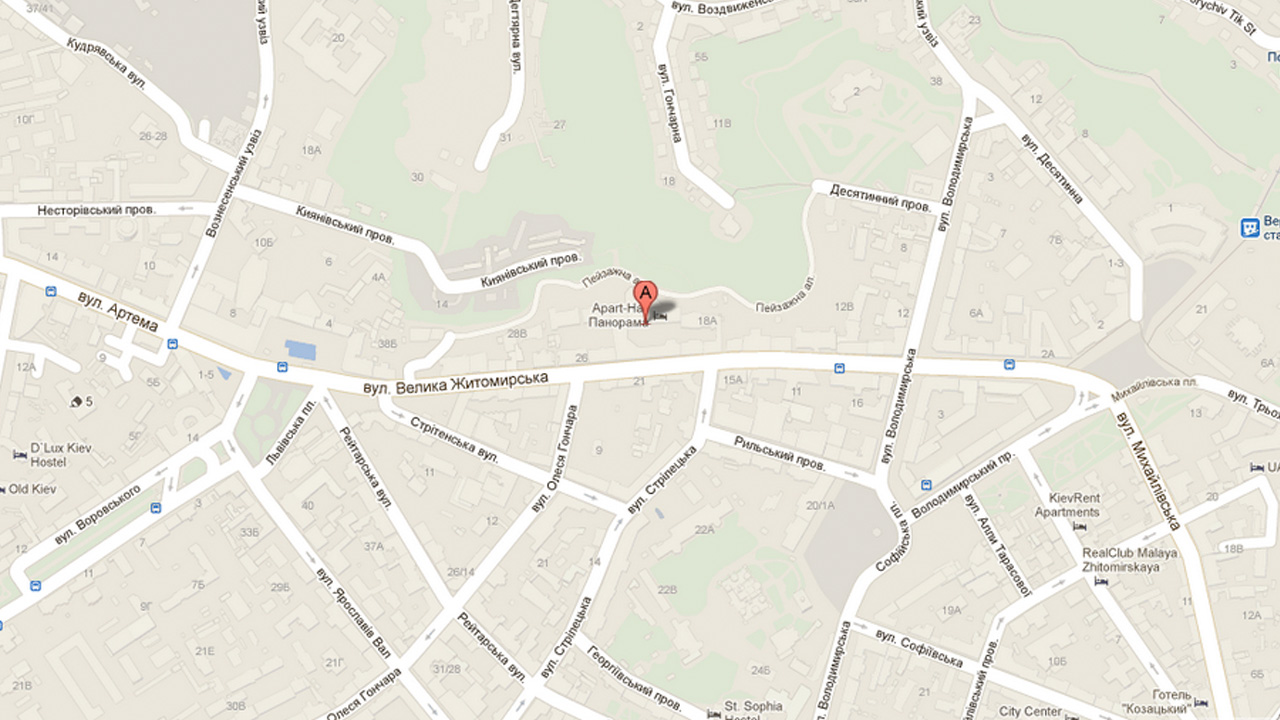

Kiev, Ukraine

no start-ups!

only acknowledged businesses, only respected people,

only key words!

DMDAYS has evolved. today we speak about business models, strategies, opportunities and niche markets, potential attractiveness and operating efficiency.

DMDAYS is the forum for companies and leaders successful in e-commerce, distance trade, customer service, payments systems, and logistics. this forum is about everything being done directly.

DMDAYS is a retrospective of solutions made and results obtained.

DMDAYS is a glance over the horizon – a chance to see (and to create!) the future of key markets.

www.taobao.com and www.aliexpress.com websites are already well-known to most professionals and a large part of consumers as shopping giants with a huge range of products and a multi-million turnover.

The flow of packages from these sites is increasing with an outstripping growth rate. Russian "add-ons" are created on these sites. The importance of China as a traditional exporter of goods for sale through the Ukrainian Internet shops is growing. Besides China is a huge, fast-growing market which has a place for goods from Europe and Ukraine. There will be a panel discussion based on all these opportunities.

Experts:

Chzhan Pei-en

an expert in trade and economic relations between China and Ukraine, TBI-Group Company (China)

Аlexey Netrusov

a co-founder of company Viva Commerce LTD, vitabao.ru (Russia)

Mukhtar Abdrakhmanov

corporate sales director, Kazpochta (Kazakhstan)

Andrey Klimenko

expert in goods delivery from China, Axiline Company

Moderators:

Igor Zubov

an expert in the sphere of distance selling, financial and transport logistics, Qiwi Post Russia Company

Andrey Illienko

a business consultant in the sphere of doing business with China, the author of www.openchina.com.ua website dealing with organizing business with China

Oksana Osmachko

an expert in service issues and building effective cooperation with China, BST Holding Limited

Aleksandr Olshanskiy

imena.UA и Mirohost.UA, owner and investor of many projects, including China-related

Ukrainian consumers have already developed a habit of buying tangible goods and we can see the figures of 5-10% of the total retail trade turnover in some product categories, but we have quite different situation concerning purchasing intangible goods and services over the Internet. The share of online sales in each category of intangible goods (air

tickets, tickets for concerts, entertainment and business events, insurance, training, discounts, etc.) today has a very low figure.Mental maturation of consumers, development of payment infrastructure, and transaction security are constraining factors. Key players of their segments will discuss how data segments are developed in Ukraine and what to expect in the near future.

Experts:

Nataliya Skazko

Head of Ukrainian representative office, Anywayanyday

Andrey Novatorov

Director, kvytky.com

Tatiana Morozova

Director for Direct Sales Development, Alfa Strakhovanie

Moderators:

Vladislav Golovin

Editor of “Predprinimateli” Column, Forbes Ukraine

Evelin Buchatskiy

Partner, accelerator of Eastlabs startups

Denis Dovgopolyi

Founder in BVU Group, Advisory Board Member in Labelgroupe

Andrey Lupyr

Head of the Board of Directors, Retail-Strakhovanie

Mikhail Deynega

Director of Groupon-Ukraine Company

Vadim Fedotov

general director, “Groupon Russia and Ukraine”

Operational part (storage facilities, fulfillment, delivery) is the bottleneck of any company selling their goods over the Internet in its literal and figurative sense. Everybody fell into the same trap of pre-holiday seasons and remember scandalous stories about incredible jam of parcels at Sheremetyevo, which became a formal reason for the resignation

of General Director of Pochta Rossii. Some online sellers start saying about setting up their own courier services, but correct assessment of their capabilities to build up all-Ukrainian logistics infrastructure are still doubtful (unless they plan to be present only in one or two large cities for a long time). Material and intellectual investments in this operational part have become a real cornerstone.

Experts:

Yuliya Pavlenko

Executive Director of the UADM

Vyacheslav Klimov

General Director, Novaya Pochta

Mikhail Pankiv

CEO of ROSAN Financial-Industrial Group, Deputy Head of the Board of Directors of Mist Express Trading House

Yevgeniy Glazov

Director, Postman

Valentin Kalashnik

Director, OS-Direct Marketing Group

Moderators:

Viktor Baranovskiy

logistics expert, ASTOR-Ukraine Company

Aleksandr Chumak

Head of Supervisory Board, Ukrcourier

Aleksandr Laskavyi

Head of Logistics Department, Yves Roches Ukraine,

Vladimir Kholyaznikov

COO and cofounder, Kupivip.ru, Russia

Aleksandra Deberdeyeva

Commercial Director, FM Logistic

Lyudmila Silantyeva

Director, VPS

In 2012 sales of household appliances and electronics in main product groups reached an amount of 44.4 billion UAH. Sales of household appliances by means of the e-commerce channel amounted to about 5 billion UAH (data of GFK Ukraine). Growth in traditional retail was 1% and 11.3% in the e-commerce channel.

In the first quarter of 2013 compared with the same period in 2012 there was a sudden lift in sales of household appliances in all categories. And again the e-commerce channel demonstrated a certain divergence in comparison with usual 40.8% vs. 15.4% respectively. According to various estimates there are 5000 to 7000 Internet shops in Ukraine. About 1300 of them operate in the segment of household appliances and electronics and bring about half of the total turnover of e-commerce. At the same time off-line players have started to actively expand into e-commerce. This is a global trend, but the Ukrainians have a popular belief that “offline is not able to work online”

Experts:

Vladislav Chechyotkin

owner, Rozetka.ua

Sergey Yeroshov

Head of projects, 5ok.com.ua / foxtrot.com.ua

Nataliya Koshevaya

Marketing Director, Comfy.ua

Moderators:

Andrey Svirskiy

Head of Retail and Technology Department, GFK Ukraine

Yevgeniy Rudenko

Allo.ua

Aleksandr Darladan

ex-head of Internet project, Eldorado.com.ua

Mikhail Vatakh

Head of Retailing Department, IT Distribution Division, MTI Company, Protoria.ua

85% of payment for goods in e-commerce today is done in cash or by bank cards. Only 15% of payment is done by means of terminals and other payment services. At the same time the share of active payment cards used aside from ATMs has doubled and reached 35% over the year. Consumers are ready to actively use e-money.

The government declares its interest in limiting cash settlements. This is the background for discussion under the guidance of two ideological antipodes – Aleksandr Olshanskiy and Aleksandr Karpov.

Experts:

Nikolay Biryuk

Development Director, Webmoney

Igor Gorin

General Director, Portmone

Yuriy Korzh

Director for Corporate Relations and Payment System Control, Global Money

Moderators:

Аleksandr Olshanskiy

imena.UA и Mirohost.UA

Aleksandr Karpov

director of the Ukrainian Interbank Payment Systems Member Association

Heads of Privat Bank, Delta Bank, Russkiy Standart Bank, Natsionalniy Kredit Bank, Ipay and other payment systems have been also invited to take part in this panel discussion

Taras Krishtal

Director, MoneXy Company

Oleg Tishchenko

Head of Electronic Banking Services Department, Ukreximbank

Sergey Shatskiy

Head of projects and programs of Department of Products for Individuals, Reiffeisen Bank Aval

Beginning from the crisis year of 2008 the services helping to buy clothes online started to emerge and develop on the CIS market. The year of 2012 became a turning point for the Ukrainian market. On the one hand, a large number of new players in this segment, which had an access to high investment, appeared and

on the other hand traditional players of catalog sales came to the Internet. Besides, many offline distributors and brand representatives started showing their activity on the Internet. Experts say this is just the beginning of new processes as the segment of selling clothes online will grow by tens or even hundreds percent per year. Despite the fact that this sphere is still in its infancy, its players already have something to discuss.

Experts:

Vladimir Kholyaznikov

COO and cofounder, Kupivip.ru (Russia)

Andrzej Malinovskiy

Director, Lamoda.UA

Olga Maslova

project manager of BonPrix.UA, OS-Direct

Aleksey Shelukhin

Head of Internet sales, Intertop.ua

Moderators:

Denis Dovgopoliy

founder of BVU Group, Advisory Board Member in Label Groupe.

Representatives of ModnaKasta.UA, Label.UA, LeBoutique. UA, Prom.UA, Intertop.UA and some research companies have been also invited to take part in this session.

Ksenia Eikhler

project manager of BonPrix.UA, OS-Direct

Dariya Cherkashina

Marketing Director, Fame.ua

Oksana Zhuravel

Marketing Director, Prom.UA

“What’s your Internet shop’s business model?” A year ago this question seemed pointless: “We just sell over the Internet”. We believed that a customer chose a low price, therefore we dumped. We were told that the service should make a customer happy, and we invested in a call center, we educated our staff, made gifts, etc.

At the same time a customer was becoming more sophisticated and pampered (or we thought it was so?). We even talked about “consumer extremism”. Servicing has started eating a margin, which is not very high. However, the situation in the market is changing. The rising cost of contextual advertising is gradually leveling the cost-effectiveness of online and offline marketing. In most industries the cost of customer acquisition is not repaid by the first deal. The rate of returns is increasing. The issue concerning importance of determining the value of each individual customer, repeat sales and database monetization (the session ‘push & money’ is devoted to it) is becoming increasingly relevant.In order to stay in business we have to find out what a consumer needs and what he is really going to pay for? What is the basis of your business model? The panel discussion will cover the following issues:

Experts:

Egor Anchishin

founder of Zakaz.ua project

Mikhail Vatakh

Head of Retailing Department, IT Distribution Division, MTI Company, Protoria.ua

Ivan Bogdan

General Director, yakaboo.ua

Moderators:

Irina Kholod

Marketing Director, Novaya Pochta

Anastasiya Gavura

Head of Distance Trade Service Department, OS-Direct Marketing Group

Heads of Sokol.ua, yakaboo.ua, allo.ua, Protoria.ua and some other commercial projects and research companies have been also invited to take part in this session

Aleksey Shelukhin

Head of Internet sales, Intertop.ua

Robert Morgunov

founder, Brand24

Tatiana Shalyga

Director of Client Service Department, Topmall.ua

Children's products are in Top-5 of all categories according to the volume of sales over the Internet. The market is growing and enlarging by 15-17% annually, such situation is determined by a stable birth rate, an ever-increasing number of Internet users and the daily routine of young moms in particular.

At the same time the market is chaotic and it’s difficult to regulate it because of a high share of low-quality counterfeit goods, more and more active trade mediation activities and cooperative buying. The price of the same product can vary significantly. The majority of manufacturers, distributors, importers and specialized retail chains have their own retail Internet sites. The largest global brands announce their entrance to the Ukrainian Internet market more and more often. Profound changes are inevitable.

Experts:

Pavel Ovchinnikov

General Director of KIDDISVIT Company (ТМ TMNT, Bburago, Lalaloopsy, Zapf)

Yuriy Karachan

Head of Internet Sales Department, Red Head Family Corporation (Antoshka retail chain, ТМ Semper, Heinz, Bübchen, Tolo)

Yekaterina Shevchuck

Head of Marketing, Best Business Group (ТМ Boikido, Cybex, Tiny Love)

Moderators:

Gennadiy Vasiliev

Head of “Zrostay Malyuk” Maternity Healthcare Support Project

Lyudmila Brizhan

Marketing Director, ITI-Group (ТМ Geoby, Goodbaby)

Oksana Zhuravel

Marketing Director, Prom.ua

Dmitriy Belyakov

Head of Sales and Client Service Department, ROSAN Financial-Industrial Group

On the one hand today it’s possible to be awash with a variety of offers from advertising and marketing agencies operating in the market, on the other hand there are many unhappy customers who can’t find effective solutions to achieve their business objectives.Customers often accuse agencies of their inability to

offer a decent solution and unwillingness to be responsible for results. But, on the other hand, customers themselves are often not willing to open detailed statistics to an agency and to release the latter from the necessity of developing projects blindfold.Within this panel the representatives of leading agencies of the country will briefly present their most successful cases for distance selling industry, cases which really give possibility to build up business. Customers will express their real attitude to these cases and approaches of the agencies.The task of the panel is not to aggravate the conflict but to hear each other and take a step for overcoming the gulf between them. We hope that in the course of this conversation, their positions will become closer and the interests of each other will become more transparent and understandable – that will be the basis of the session “Effective Marketing”

Experts:

Aleksandr Kolb

General Director, Promodo

Yevgeniy Shevchenko

General Director, UaMaster Company

Yuriy Babich

Director, SOHO

Aleksandr Fedotov

Head of Complex Project Department, Ashmanov and Partners

Moderators:

Liliya Gorelaya

Managing Partner, OS-Direct Marketing Group

Vladyslav Chechyotkin

Director, Rozetka.ua

Heads of the largest online-retailers and digital agencies have been also invited to take part in this session

Andrey Sukhovoi

Manager for Analytical Services Development, OWOX Company

Roman Rybalchenko

Founder of Roma.net.ua project, Marketing Director of Intimo Internet-shop, corporate coach of SEO-Studio

Mikhail Deynega, Director

Groupon Ukraine Company

Vadym Philipenko

General Director Advisor for Strategic Marketing, Aukro.UA, Allegro Group Ukraine

Nataliya Koshevaya,

Marketing Director, Comfy.ua

Under the auspices of Human Capital Forum, the 2nd International Exhibition and Forum on Human Capital Management Companies are rapidly developing thus stimulating market development as well. Management practices acceptable for a small company do not work with fast growing companies. At the same time the country suffers rampant degradation of the educational system and decline of motivation.

On the other hand the competition of companies for intelligent prospective employees is growing, and the market is often going through an artificial boom in salaries which is not justified at all. Many positions in Ukrainian companies are paid higher than those in Poland, Hungary and other Eastern European countries. But even the question of money solves the problem not for a long time.The difficulties covered in this section are global and significant; they can not be solved within a couple of hours. But the experts will try to give key recommendations together with the partners of Human Capital Forum:

Moderators:

Yevgeniy Pesternikov

Vice President, Kiev Business School; member of WikiCityNomika Team

Representatives of leading Ukrainian business schools have been also invited to take part in this session.

Anna Korytina

organization issues

Т: 38 044 490 90 88

38 067 294 23 23

@: korutina@osdirect.com.ua

Yulia Pavlenko

partnership issues

Т: 38 044 490 90 88

38 096 757 07 05

@: pavlenko@uadm.com.ua

Nikita Kovalenko

mass media cooperation

Т: 38 044 490 90 88

38 067 737 58 17

@: kovalenko@osdirect.com.ua

Marina Kravchenko

back-office

Т: 38 044 490 90 88

38 093 483 53 66

@: kravchenko.maryna@osdirect.com.ua